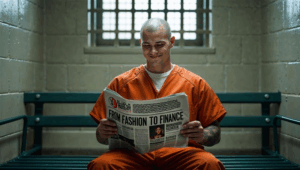

Managing money is an essential life skill, yet it is often overlooked, especially for individuals navigating life in correctional facilities. At MailCall Newspaper, we understand the unique challenges faced by inmates when it comes to financial literacy. That’s why we’ve created a comprehensive guide to help inmates master their money behind bars, equipping them with the tools and knowledge to take control of their finances both during incarceration and upon reentry into society.

In this blog, we explore how MailCall covers financial education in an accessible and practical way, breaking down complex concepts into actionable steps.

Why Financial Literacy Matters for Inmates

Financial literacy isn’t just about counting money, it’s about understanding how to budget, save, invest, and make informed financial decisions. For inmates, learning financial skills can:

- Prepare them for life after release

- Prevent financial mistakes that could lead to legal trouble

- Help them support themselves and their families

- Provide a sense of empowerment and independence

MailCall Newspaper brings financial literacy to inmates in a practical, step-by-step format, ensuring that even those with little prior knowledge can understand and apply these lessons.

How MailCall Covers Financial Literacy

At MailCall, our financial literacy section is more than just articles, it’s a full educational experience designed specifically for inmates. Here’s how we deliver this essential content:

1. Simple, Clear Explanations

Complex financial topics like investments, stocks, and retirement planning can be intimidating. MailCall breaks them down using simple language and relatable examples so that every inmate can understand:

- Budgeting: How to track your income and expenses, even with a limited allowance

- Saving: Simple ways to build savings, like using commissary accounts effectively

- Investing Basics: Understanding risk, returns, and long-term growth

2. Step-by-Step Guides

Our articles often include step-by-step instructions, allowing readers to follow along and apply what they’ve learned immediately. Examples include:

- How to create a monthly budget with limited funds

- Setting financial goals and tracking progress

- Tips for reducing debt and avoiding scams

3. Interactive Content

MailCall Newspaper also features interactive sections, such as financial exercises, quizzes, and games. These engage readers while reinforcing financial principles in a practical way.

- RPG-Style Financial Challenges: Solve money management problems in a game format

- Quizzes: Test your knowledge on saving, investing, and spending

- Scenario Exercises: Learn how to handle real-world financial decisions

4. Exclusive Insights and Tips

We bring exclusive insights from financial experts, giving inmates access to professional advice they might not otherwise receive.

- Investment Strategies: Learn safe and practical investment approaches

- Budget Optimization: How to stretch limited resources effectively

- Financial Planning: Steps for building long-term wealth

Core Financial Literacy Concepts Covered by MailCall

The financial literacy section of MailCall Newspaper is designed to cover all critical areas of money management:

1. Budgeting and Money Management

Budgeting is the foundation of financial literacy. MailCall guides inmates on how to:

- Record all income sources, including commissary funds and personal money

- Categorize expenses into essentials (food, hygiene) and discretionary spending

- Set spending limits to avoid running out of funds

2. Saving and Emergency Funds

Even with limited income, MailCall teaches the importance of saving for:

- Emergencies or unexpected expenses

- Future reintegration into society

- Supporting family members if possible

We provide actionable tips for building savings, like prioritizing small, consistent contributions to a secure account.

3. Understanding Debt and Credit

Debt can be a significant challenge both inside and outside prison. MailCall covers:

- The dangers of predatory lending

- How to manage existing debt responsibly

- Planning for debt repayment after release

By understanding credit and debt, inmates can avoid pitfalls that could affect their financial future.

4. Basics of Investing

While investing may seem far off for inmates, learning the basics of stocks, bonds, and other investment vehicles is crucial. MailCall simplifies these concepts, helping readers:

- Understand risk vs. reward

- Recognize long-term growth opportunities

- Learn strategies that can be implemented after release

5. Financial Goal Setting

Setting realistic financial goals is a key part of building wealth. MailCall encourages inmates to:

- Define short-term and long-term goals

- Track progress consistently

- Adjust strategies when necessary

Real-Life Examples and Success Stories

MailCall Newspaper also includes stories of inmates who have successfully applied financial literacy principles to improve their lives:

- How budgeting in prison helped one inmate save for a small business after release

- Using simple savings strategies to send money to family and build trust

- Learning investing basics while incarcerated, leading to informed financial decisions post-release

These examples make financial literacy relatable, inspiring, and actionable.

Subscribe to MailCall Newspaper

To gain full access to the financial literacy section and all other valuable content, make sure to subscribe to MailCall Newspaper. Stay updated with step-by-step guides, expert tips, and practical advice to master your money behind bars. MailCall brings you tools for financial success, whether you are preparing for life after prison or improving your money management today. Don’t miss out—subscribe now and start your journey to financial freedom!

How MailCall Makes Learning Easy and Accessible

MailCall understands the challenges inmates face in accessing educational content. That’s why our financial literacy section is:

- Written in simple, clear language for easy understanding

- Formatted with headings, bullets, and step-by-step instructions to make learning structured

- Interactive and engaging, using quizzes, games, and exercises

- Practical, focusing on real-world applications rather than theory

By combining these elements, MailCall Newspaper ensures that every reader can build financial skills effectively, even with limited resources.

Conclusion: Master Your Money with MailCall

Financial literacy is not just a skill, it’s a lifeline. With the right knowledge, inmates can take control of their finances, plan for the future, and build independence. MailCall Newspaper makes this possible by offering easy-to-understand guidance, practical exercises, and expert insights.

From budgeting and saving to investing and goal-setting, our financial literacy section covers everything inmates need to know to master their money behind bars. By subscribing to MailCall Newspaper, readers gain access to exclusive tips and strategies designed specifically for their unique circumstances.

Empower yourself with knowledge. Take the first step toward financial freedom today with MailCall Newspaper.